April - June 2020 Update

United States

Anthony S. Ferrara

Despite requesting additional time to review pending mergers, the US antitrust agencies have continued their work through the COVID-19 pandemic. The Department of Justice (DOJ) and Federal Trade Commission (FTC) reached settlements with a number of merging parties during Q2 2020, and the FTC is proceeding to trial in several merger cases. Both the FTC and the DOJ are conducting investigational hearings and depositions via remote videoconferencing technology such as Zoom. The FTC also announced it prevented 12 deals from closing in 2020 despite the COVID-19 pandemic. Five of the transactions were blocked and another seven were abandoned due to antitrust concerns, putting the FTC on pace for one of its busiest years for merger enforcement in the past 20 years.

Europe

In light of the COVID-19 outbreak, the European Commission (EC) warned that merger control filings would likely not be processed as swiftly as usual. The EC encouraged parties to postpone merger notifications because the EC envisaged difficulties, within the statutory deadlines imposed by the EU Merger Regulation, to elicit relevant information from third parties, such as customers, competitors and suppliers. In addition, the EC foresaw limitations in accessing information remotely. This period thus saw a drop in merger notifications to the EC; however, notifications increased in June and July.

Snapshot of Events

United States

Anthony S. Ferrara

- Merger Enforcement Agencies Continue Work Amid COVID-19 Pandemic

DOJ and FTC have continued their work amid the COVID-19 pandemic. DOJ announced in March that for mergers currently pending or that might be proposed, it would be requesting an additional 30 days under its timing agreements to complete its review of transactions. The FTC has also been requesting additional time for reviews in its timing agreements with merging parties. Despite the disruptions and challenges presented by the COVID-19 pandemic, both agencies have continued to review transactions and reach settlements with merging parties. The FTC is also proceeding to trial in multiple cases and has lifted stays of discovery that were originally put in place at the beginning of the pandemic. - Vertical Merger Guidelines

On June 30, 2020, the FTC and DOJ released new Vertical Merger Guidelines, which replace the Non-Horizontal Merger Guidelines published in 1984. The FTC’s vote to issue the guidelines was 3-2, with the FTC’s two Democratic commissioners, Rebecca Slaughter and Rohit Chopra, dissenting. The new Vertical Merger Guidelines are effective immediately. The agencies previously released draft guidelines in January 2020. The final guidelines include revisions in response to more than 70 public comments. One notable change in the final guidelines is the removal of a “safe harbor” for certain transactions based on market shares. The agencies previously said they were unlikely to challenge a vertical merger where the parties to the merger have less than a 20% share in the relevant market and the “related product” is used in less than 20% of the relevant market. The agencies removed this provision in the final guidelines. - Merger Filings Decline/Restructurings Increase

Agency data show that Hart-Scott-Rodino (HSR) filings declined in the first few months of the pandemic. There were 138 HSR filings in March, compared to just 79 filings in April and 73 filings in May. Since May, filings have returned to a more normal pace: There were 111 filings in June and 112 filings in July. We have observed more filings for restructurings, and this trend may continue in light of the current economic climate.

Europe

- Directorate-General for Competition (DG COMP) Operated with Special Procedures During the Lockdown

In March 2020, the EC requested that parties to a proposed merger delay notifications to the extent possible, and to discuss the timing of transactions with the case teams. DG COMP indicated, however, that it would still accept notifications where there were “very compelling reasons to proceed with a merger notification without delay.” A principal reason for the EC’s request that notifications be put on hold was that it envisaged difficulties in collecting information from the merging parties and from the market (e.g., customers, competitors and suppliers). As a result, this period saw a lower number of merger notifications to the EC.DG COMP requested those members of staff working in “noncritical” roles to work remotely. Staff working in “critical” roles, however, were requested to work from the EC’s premises on a rotational basis. This new working arrangement also explained the EC’s request that merging parties hold off from notifying proposed mergers, particularly during the early stages of the COVID-19 outbreak. Some staff members have since returned to the office, but most staff members continue to work remotely. Based on the number of filings in June and July, it appears the EC is now accepting merger notification filings on a regular basis. - The EC Did Not Relax Its Approach to the “Failing Firm Defence” During COVID-19

Under the EU merger control rules, an otherwise problematic concentration is compatible with the internal market if a party to the concentration is a “failing firm.” In April 2020, Competition Commissioner Margrethe Vestager made it clear, however, that mergers would be subject to the ordinary review procedure and that the failing firm defence “shouldn’t be a shield to allow mergers that would hurt consumers and hold back the recovery.” The failing firm defence standards are strict, and the EC said that it would not relax its approach because of COVID-19. The United Kingdom’s Competition and Markets Authority (CMA) also stated that it would not relax its merger assessment standards in response to COVID-19. However, the CMA authorized at least one transaction to move forward under the failing firm defence. - The UK CMA Continues to Flex Its Muscles

The UK CMA continues to be very active with many high-profile merger reviews. In April 2020, the CMA blocked the Sabre/Farelogix merger after finding that the deal would have resulted in less innovation with respect to the US airline technology companies’ services, higher fees for certain products and more limited choice of suppliers for airlines using the companies’ IT systems. Sabre appealed the decision to the UK Competition Appeal Tribunal (CAT). In May, the CMA blocked the merger between the sportswear retailers JD Sports and Footasylum, concluding that the transaction between these two close competitors would have substantially eliminated competition in the United Kingdom. JD Sports is expected to appeal the decision to the CAT in September.

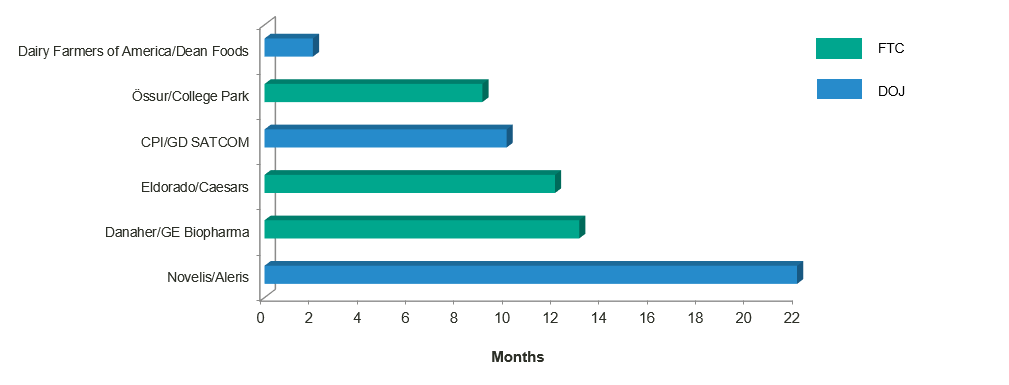

SNAPSHOT OF SELECTED ENFORCEMENT ACTIONS*

United States (Time from Signing to Consent or Investigation Closing)

*These graphs and the summaries that follow do not represent a complete list of all matters within a jurisdiction. Certain matters involving firm clients are not included in this report.

Europe (Time from Signing to Clearance)

*These graphs and the summaries that follow do not represent a complete list of all matters within a jurisdiction. Certain matters involving firm clients are not included in this report.

Significant US Trials

| PARTIES | AGENCY | COURT | MARKETS / STRUCTURE (AS AGENCY ALLEGED) | MAJOR ISSUES | OBSERVATIONS |

| United States | |||||

| Altria Group / JUUL Labs | FTC | Part 3 Administrative Proceeding | Closed-system electronic cigarettes

JUUL “dominated” the relevant market with 70% market share; Altria was the second-largest player |

Did Altria’s investment in JUUL and agreement to exit the e-cigarette market eliminate a competitive threat to JUUL? | The FTC filed a Part 3 administrative complaint against Altria Group and JUUL Labs, seeking to unwind a series of agreements between the companies whereby Altria allegedly agreed to cease competing in the e-cigarette market in exchange for a 35% stake in JUUL. The FTC alleges that JUUL was the dominant player in the e-cigarette market at the time of the agreements, and that the agreements harmed competition by securing Altria’s exit from the market. According to the FTC, consumers lost the benefit of current and future head-to-head competition between Altria and JUUL, and between Altria and other competitors.

The FTC proceeding has been stayed multiple times due to the COVID-19 pandemic, and the evidentiary hearing is currently scheduled for April 2021. |

| Arch Coal / Peabody Energy | FTC | FTC Administrative Complaint / US District Court for the Eastern District of Missouri | Coal mining operations in the southern Powder River Basin in northeastern Wyoming

Top two producers with combined share of 60% |

Should the product market be limited to Powder River Basin coal production or include competition from natural gas and other alternative fuels? | The FTC filed a complaint against a proposed joint venture between Arch Coal and Peabody Energy on February 26, 2020. The FTC also sought a temporary restraining order and preliminary injunction from the US District Court for the Eastern District of Missouri. The FTC alleges that the merger would eliminate head-to-head competition between the two largest coal mining companies in the United States, who control 60% of all coal mined in the southern Powder River Basin of Wyoming. The parties argue for a wider product market definition, to include natural gas and other alternative fuels.

The federal court hearing took place in July and August, and the FTC administrative trial began on August 11, 2020. |

| Jefferson Health / Albert Einstein Healthcare Network | FTC / Pennsylvania Attorney General | FTC Administrative Complaint / US District Court for the Eastern District of Pennsylvania | Inpatient general acute care hospital services and inpatient acute rehabilitation services in Philadelphia and Montgomery Counties, Pennsylvania

Alleged combined shares of between 45% and 70% in different service lines in north Philadelphia and Montgomery County |

Will the merger eliminate competitive pressure that has driven quality improvements and lowered rates, or will the merger result in price efficiencies and cost synergies?<?span>

Is the relevant geographic market confined to the northern Philadelphia and Montgomery County areas? |

The FTC sued to block the merger of Jefferson Health and Albert Einstein Healthcare Network, two hospital systems in Pennsylvania. The FTC argues that Jefferson and Einstein compete to improve quality and service by upgrading medical facilities and investing in new technologies. The FTC believes that together, the parties would control 60% of inpatient general acute care hospital services in north Philadelphia and 45% in Montgomery County, and 70% of inpatient acute rehabilitation services in Philadelphia.

The FTC also filed for a temporary restraining order and preliminary injunction in the US District Court for the Eastern District of Pennsylvania. The administrative trial is scheduled to begin on January 5, 2021. The FTC issued several stays of the proceedings in response to the COVID-19 pandemic and set a new scheduling order on July 13, 2020. |

| Axon Enterprise, Inc. / VieVu | FTC | FTC Administrative Complaint / US District Court for the District of Arizona | Sale of body-worn cameras and digital evidence management systems to large metropolitan police departments

Merger of two close competitors |

Is the body-worn camera product market limited to large police departments (500 or more sworn officers)? Can other video technology companies enter the body-worn camera market?

Does the US Constitution allow the FTC to challenge consummated transactions in its own internal administrative proceedings? |

The FTC filed an administrative complaint challenging Axon Enterprise, Inc.’s consummated acquisition of VieVu from Safariland, LLC. The FTC also challenged noncompete agreements that Axon and Safariland signed in connection with the acquisition. The FTC alleged that VieVu was Axon’s closest competitor in the sale of body-worn cameras and digital evidence management systems to large metropolitan police departments. By defining a narrow “price discrimination market” around a specific category of customer, the FTC determined that large metropolitan police departments have distinct requirements for these products that differ from other law enforcement organizations.

In response, Axon filed a complaint in the District of Arizona, arguing that the FTC’s administrative process is unconstitutional, and alleging that the structure of the FTC is unconstitutional due to the limited ability to remove FTC commissioners. Axon sought a preliminary injunction to place the administrative matter on hold. On March 10, 2020, Judge Dominic Lanza issued a tentative ruling stating that the court lacks subject matter jurisdiction and the issues should be raised during the administrative process, and if necessary, appealed to the US Court of Appeals for the Ninth Circuit. In the second quarter, on April 8, 2020, Judge Lanza finalized his order and dismissed Axon’s constitutional claims. On April 13, 2020, Axon filed a notice of appeal to the Ninth Circuit. The administrative trial was originally scheduled to begin May 19, 2020, but was stayed due to the COVID-19 pandemic. The administrative trial is now scheduled to begin on October 13. Discovery is ongoing. |

Significant US Consent Orders / Investigations Closing with Agency Statements

| BUYER | TARGET | INDUSTRY / STRUCTURE (AS AGENCY ALLEGED) | SIGNING TO CONSENT | AGENCY | DETAILS* | BUYER UPFRONT |

| Dairy Farmers of America, Inc. (DFA) | Dean Foods Co. | Processing and sale of fluid milk in several geographic markets

Prior to bankruptcy, Dean Foods was the largest fluid milk processor in the United States; DFA also owned multiple processing plants |

2 months | DOJ | In November 2019, Dean Foods, the largest fluid milk processor in the United States, filed for Chapter 11 bankruptcy, and the bankruptcy court ordered an auction. DFA bid on 44 of Dean’s plants for a total value of $433 million. No other bidder submitted a bid for these plants. DFA and Dean entered into an asset purchase agreement in March 2020. DFA agreed with the DOJ to divest three Dean processing plants in geographic markets where DFA also owned processing plants. | No |

| Össur hf. | College Park Industries | Myoelectric elbows

4 to 3 |

9 months | FTC | College Park is a leading supplier of myoelectric, or powered, elbows, and Össur is currently developing its own myoelectric elbow. The FTC alleged that there are only two other participants in the US myoelectric elbow market. The FTC required the parties to divest College Park’s myoelectric elbow business to Hugh Steeper Ltd. | Yes |

| Communications and Power Industries LLC (CPI) | General Dynamics SATCOM Technologies (GD SATCOM) | Large geostationary satellite antennas

CPI and GD SATCOM are the only two significant suppliers |

10 months | DOJ | Pursuant to a July 2019 purchase agreement, CPI agreed to acquire GD SATCOM from its parent company, General Dynamics. The DOJ alleged that CPI and GD SATCOM are the only two significant suppliers of large ground station antennas for geostationary satellites, a key component of communications networks utilized by the US Department of Defense (DoD) and commercial customers. According to the DOJ, the proposed acquisition would have left the DoD and commercial customers without meaningful competitive alternatives. The DOJ required the parties to divest CPI’s wholly owned subsidiary, CPI ASC Signal, for CPI to proceed with the acquisition. | No |

| Eldorado Resorts | Caesars Entertainment | Casino services in three geographic markets

3 to 2 in south Lake Tahoe area; 5 to 4 in Bossier City-Shreveport area; 5 to 4 in Kansas City area |

12 months | FTC | The FTC alleged that Eldorado’s acquisition of Caesars would harm competition for casino services in three geographic markets. The FTC required Eldorado to divest to Twin River Worldwide Holdings casinos in the south Lake Tahoe and Bossier City-Shreveport areas. Eldorado independently agreed to sell its casino in Kansas City to another buyer. | Yes |

| Danaher | GE Biopharma | Various products used for research and development (R&D) of biopharmaceutical drugs

Danaher and GE are 2 of a limited number of significant participants in each relevant market |

13 months | FTC | Danaher proposed to acquire the GE Biopharma business in a transaction valued at approximately $21.4 billion. The FTC alleged that Danaher and GE Biopharma were two of a limited number of significant participants in the markets for several products used to support the research and development of biopharmaceutical drugs, and that the proposed acquisition would substantially reduce competition in each of these markets. The FTC required Danaher to divest its products in the relevant markets to Sartorius. | Yes |

| Novelis Inc. | Aleris Corp. | Automotive body sheets

Novelis and Aleris are 2 of 4 firms that produce automotive body sheets in North America; combined they would have more than half of domestic sales and 60% projected total domestic capacity |

22 months | DOJ | The DOJ invoked its authority to send the challenge of the $2.6 billion Novelis Inc./Aleris Corp. merger to arbitration. On March 9, 2020, the arbitrator, Kevin Arquit (a former FTC official), agreed with the DOJ that the relevant product market included only aluminum automotive body sheets, and not steel automotive body sheets. On May 12, the DOJ filed a proposed final judgment with the US District Court for the Northern District of Ohio requiring the divestiture of Aleris’ North American aluminum automotive body sheet operations, including a plant in Kentucky. | No |

*The information in this column summarizes the government’s allegations. McDermott Will & Emery LLP offers no independent view on these allegations.

Significant European Clearance Decisions

| BUYER | TARGET | INDUSTRY | SIGNING TO CLEARANCE | AGENCY | DETAILS* | BUYER UPFRONT |

| Europe | ||||||

| Gategroup | Lufthansa Service Group’s (LSG) European business (excluding LSG’s retail onboard business) | In-flight catering services | 4 months | EC | The EC approved the acquisition of LSG’s European business (excluding LSG’s retail onboard business) by Gategroup, subject to conditions.

The EC’s investigation found that the transaction, as initially notified, would have led to a quasi-monopoly or would have left, at most, only one remaining viable competitor in the markets for in-flight catering services at Brussels, Berlin-Tegel, Cologne, Düsseldorf, Frankfurt, Hamburg, Hannover, Munich, Paris Charles de Gaulle and Rome Fiumicino airports. Gategroup committed to divest the overlap businesses to facilitate the entry or expansion of competing in-flight caterers at the relevant airports. The divested businesses included customer in-flight catering contracts and facilities, other tangible assets such as high-loaders, personnel and certain intangible assets. |

No |

| Mylan | Upjohn | Generic pharmaceuticals | 9 months | EC | The EC approved the merger between Mylan and Upjohn, a business division of Pfizer, which operates Pfizer’s off-patent branded and generic pharmaceuticals.

Mylan and Upjohn overlap in various therapeutic areas such as cardiovascular, genitourinary, musculoskeletal, nervous system and sensory organ treatments. Although the EC’s investigation found that no competition concerns arose for the majority of products, it found that, in some countries and for some molecules, the transaction would raise competition concerns because of the strong position of the two companies, and the limited number of significant competitors, in particular, with respect to 36 molecule-country pairs. To address these concerns, Mylan and Upjohn agreed to divest Mylan’s business in the relevant markets, including certain generic pharmaceuticals across 20 countries throughout the European Economic Area. The proposed commitments removed the entirety of the overlaps between Mylan and Upjohn in the markets that raised concerns. |

Yes |

| Aurubis | Metallo | Refining of copper scrap | 11.5 months | EC | The EC approved Aurubis’ acquisition of Metallo, following an in-depth investigation.

Aurubis (Germany) is the largest integrated copper producer in Europe and the world’s largest refiner of copper scrap. Metallo Holdings (Spain) is also specialized in copper scrap refining. Both companies are important buyers of copper scrap from industrial production and end-of-life products within the European Economic Area. The EC distinguished copper scrap for refining from copper scrap for direct melt. Within copper scrap for refining, different markets exist for the relatively standardised products “copper scrap #2” and e-scrap, as well as for the more heterogeneous copper scrap for smelting and refining. The EC had concerns that the increased buyer power of the merged company would give it a dominant position in scrap purchasing with the effect of impairing the functioning of the copper recycling market, specifically harming industrial suppliers of copper scrap, which sell scrap as a by-product of their production process. Ultimately, the EC’s concluded that the transaction was unlikely to result in significant harm to suppliers of copper scrap for smelting and refining. |

N/A |

| Elanco Animal Health Inc. | Bayer AG’s Animal Health division | Animal health | 9.5 months | EC | The EC approved Elanco’s acquisition of Bayer’s Animal Health (BAH) division, subject to conditions.

Both Elanco and BAH develop and supply pharmaceuticals for pets and livestock. The transaction would have led to the creation of the second-largest animal health company globally. The EC found that the transaction, as originally notified, would have raised competition concerns in a number of countries in the European Economic Area in relation to otitis products for pets, as well as several types of parasiticides, namely: (i) anticoccidials for ruminants (cattle and sheep); and (ii) parasiticides for pets (treatments against parasites). In these markets, both companies have strong positions and/or face a limited number of competitors. To address these concerns, Elanco and BAH agreed to divest Elanco or BAH’s products and/or pipeline products in relation to otitis, anticoccidials and parasiticides for pets in the European Economic Area, including all the necessary assets such as applicable licenses, contracts and brands, as well as relevant studies and data. |

Yes |

* The information in this column summarizes the government’s allegations. McDermott Will & Emery LLP offers no independent view on these allegations.

Significant Challenged or Abandoned Transactions

| BUYER | TARGET | INDUSTRY | AGENCY | DETAILS* |

| United States | ||||

| Cengage Learning Holdings II Inc. | McGraw-Hill Education Inc. | Textbooks | DOJ | Cengage and McGraw-Hill agreed to abandon their plans to merge after the DOJ informed the parties it had serious concerns that the proposed transaction would harm competition. According to the DOJ, the merger would have combined the second- and third-largest publishers of textbooks in the United States in a market long dominated by three major textbook publishers. |

| Sabre Corp. | Farelogix Inc. | Global distribution systems for airline tickets | DOJ | The DOJ sued to block Sabre’s proposed acquisition of Farelogix in August 2019. The DOJ argued that the parties are direct competitors for global distribution systems for airline tickets and that the acquisition would eliminate Farelogix as a disruptive competitor. Following an eight-day bench trial in the US District Court for the District of Delaware, the district court denied the DOJ’s request to block the merger. Just two days after the district court issued its opinion, however, the United Kingdom’s CMA found the deal unlawful under UK competition law. The parties abandoned the transaction following the CMA decision. On May 12, the DOJ moved to vacate the district court’s decision. The US Court of Appeals for the Third Circuit vacated the district court’s decision on July 20. |

| Johnson & Johnson | TachoSil | Fibrin sealant patches | FTC | Johnson & Johnson proposed to acquire Takeda’s surgical patch, TachoSil. The FTC investigated the transaction, focusing the potential loss of competition between TachoSil and Johnson & Johnson’s Evarrest—the only two fibrin sealant patches approved in the United States to stop bleeding during surgery, according to the FTC. The FTC staff had significant concerns and recommended that the Commission block the transaction, and the parties abandoned the deal. |

| Europe | ||||

| Sabre Corp. | Farelogix Inc. | Global distribution systems for airline tickets | UK CMA | The CMA prohibited Sabre Corp.’s proposed acquisition of Farelogix Inc., following an in-depth Phase II investigation.The CMA focused on the overlaps in the markets for the supply of merchandising and distribution solutions to airlines. It concluded that the transaction would result in a substantial lessening of competition in the supply of merchandising solutions to airlines on a worldwide basis, including in the United Kingdom, and in the supply of distribution solutions to airlines on a worldwide basis, including in the United Kingdom.

Farelogix used a technology—Global Distribution System—which allows travel agencies to search for and book flights across multiple airlines, and Sabre is developing a similar technology. The CMA asserted that if Sabre were to acquire Farelogix, it would be unlikely that Sabre would develop the technology itself. The CMA concluded that airlines, and ultimately their passengers, would lose out from both this reduction of innovation and the insufficient competition between the remaining companies in the market. Sabre appealed the decision to the UK CAT. |

| JD Sports Fashion | Footasylum | Sports-inspired casual footwear and apparel retailing | UK CMA | The CMA prohibited JD Sports Fashion’s proposed acquisition of Footasylum, following an in-depth Phase II investigation.

The CMA found that the acquisition would lead to a substantial lessening of competition in sports-inspired casual footwear and apparel products sold both in-store and online, in the United Kingdom. The CMA asserted that the merger would lead to the elimination of an important source of competition, the parties being close competitors and JD Sports Fashion being the largest retailer in these markets. |

* The information in this column summarizes the government’s allegations. McDermott Will & Emery LLP offers no independent view on these allegations.